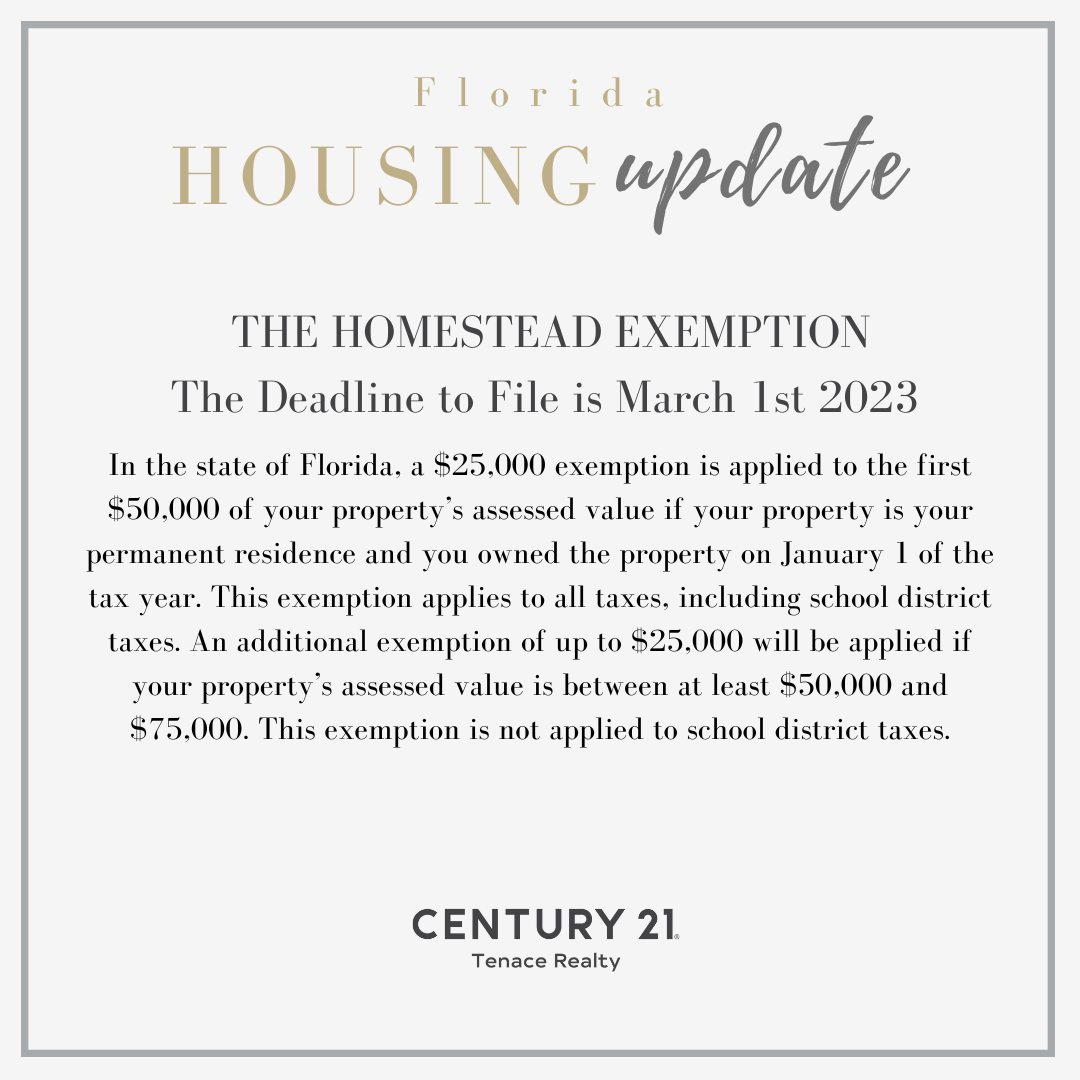

Shout out to all the homebuyers of 2022! If you haven’t done so already, It is time to file for your homestead exemption!

Deadline is MARCH 1st 2023

You will need the following documents for all property owners applying:

Florida Driver’s License or Florida ID if you do not drive

Florida car registration

Florida Voter’s ID (if you vote)

Immigration documents if not a U.S. citizen.

Documents should reflect the address of your homesteaded property. You have to submit your application by:

E-File:

Saint Lucie County: https://apps.paslc.gov/homestead/

Martin County: https://www.pa.martin.fl.us/homestead-exemption/apply-online

Palm Beach County: https://www.pbcgov.org/papa/homestead-exemption.htm

Or

Complete the application online, Print it out and mail to:

Saint Lucie County: Saint Lucie Property Appraisers Office, Saint Lucie West 250 NW Country Club Dr, Port Saint Lucie, FL 34986

Palm Beach County: The Palm Beach County Property Appraiser’s Office, Exemption Services,1st Floor, 301 N. Olive Ave., West Palm Beach, FL 33401

Martin County: Martin County Property Appraisers Office, 3473 SE Willoughby Blvd. Suite 101, Stuart, FL 34994

You can just go into the office and apply also.

Additionally, anyone who owned a homesteaded home, sold it and repurchased…you also need to file for your portability transfer. click here for the Portability application (hard copy).

Anyone thinking about selling should be assessing/adjusting their market values PRIOR to listing their house for sale.

This can potentially save you hundreds and in some cases THOUSANDS on your property taxes when you transfer your homestead.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link